How Will the Base Ecosystem Proceed After Friend.tech?

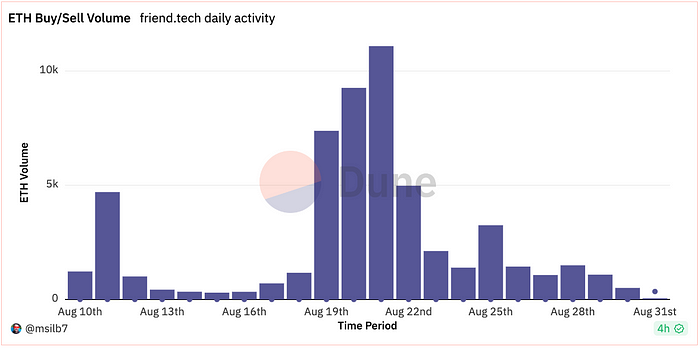

Two weeks after the launch of Friend.tech on the Base chain, its user activity began to wane. There was even a net outflow of ETH in the contract on August 22nd. Currently, the amount of ETH retained in the contract is about 3,500, valued at approximately 5.8 million USD. Beyond Friend.tech, how is the development of the Base chain ecosystem?

I. On-chain Data

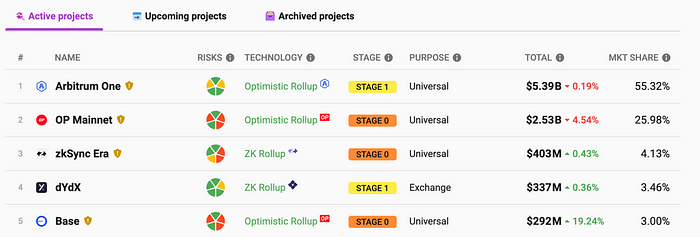

1. TVL (Total Value Locked)

As of August 27, the Base chain’s TVL reached 292 million, ranking fifth among layer-2 networks, accounting for 3% of the layer-2 market share. Both Base and zkSync have witnessed a slow growth in TVL, showing signs of stagnation.

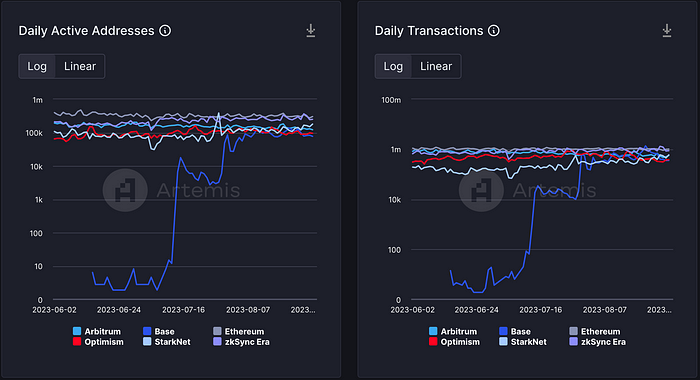

2. Transaction Volume and Active Addresses

There were two rapid growth periods for daily active addresses and daily transaction volume, corresponding to the launch of the Base chain mainnet and Friend.tech. As of August 31, the daily active transaction address number stood at 77,000, with a daily transaction count of 356,000. Both figures are lower than those of layer-2 networks like Arbitrum, Optimism, and zkSync.

The trading volume on the Base DEX hit a low point on August 3 after the meme coin trend ended. This was followed by a rebound in trading volume due to a series of new projects on the chain.

However, after a market downturn on August 16, the volume began to shrink again.

II. Ecosystem Projects

As of August 27, the official Base website had listed a total of 143 projects/partners. Defillama had a record of 69 projects, of which only 23 had a TVL exceeding 1 million. Among these, 12 were DEXs.

DEX

Initially, the exchanges with significant trading volumes on the Base chain were Leetswap and Rocketswap. However, both encountered security incidents. The current leading native DEX is Aerodrome, which has a prominent TVL status. This DEX recently initiated liquidity mining and offers a high APY. Aerodrome is a Base liquidity layer co-developed by the Velodrome and Base teams, along with partners. The initial supply is 500M AERO, of which 450M (90%) will be locked as veAERO. AERO’s initial circulation is 10M. From the 1st to the 14th cycle, the weekly release will increase by 3% based on the previous week. From the 14th week to around the 67th week, the weekly release will decrease by 1%. Overall, AERO can be categorized as a mining coin, and its circulation has increased rapidly in a short period. Baseswap and Alien base saw declines in TVL and price after the launch of Aerodrome.

Certainly, here’s a professional, native, and precise translation of the provided text:

Lending

Currently, the largest lending protocol on the Base chain is Compound with a TVL (Total Value Locked) of 23.35 million. Following it is the native Moonbeam lending protocol, Moonwell, with a TVL of 19.42 million. Aave went live on the Base chain on the evening of August 20th after a vote, and its current TVL stands at 1.68 million.

The contract deployer of the previously largest native lending protocol on the Base chain, Magnate Finance, is linked to the Solfire scam. Currently, the project’s Twitter account has been deactivated. The TVLs of other lending protocols, Grannay Finance and UncleSam protocol, are both less than 1 million USD. Compared to established lending protocols like Compound and Aave, they lag behind in brand recognition, security, and liquidity.

Derivatives

EDEBASE has implemented a hybrid liquidity mechanism. It allows ELP holders to provide liquidity via a smart router. 45% of the protocol’s revenue is distributed to ELP token holders and stakeholders. This mechanism is similar to GMX. The current TVL is 0.19 million.

Meridian Trade offers interest-free stablecoin lending, leverage trading, and zero slippage transactions. Users can leverage trade whitelisted crypto assets up to 50x and obtain over-collateralized, interest-free loans in ETH. The current TVL stands at 50,000 USD.

Social Platforms

Friend.tech garnered a lot of attention and substantial capital inflow in mid-August. However, starting from August 22nd, there has been a noticeable outflow of funds from Friend.tech, and trading activity has noticeably decreased.

Gaming

Parallel is a collectible card game that secured 50 million USD in funding from Paradigm in 2021, valuing it at an estimated 500 million USD at the time. At the end of July, the beta test of the game was launched, placing its NFT cards on the Base chain for minting.

Conclusion

The native projects on the Base chain have frequently encountered ‘rug pull’ events. From a price-performance perspective, secondary participation carries significant risks. In terms of ecosystem development, high-profile projects like Unibot are still actively joining the Base ecosystem.

LD Capital is a leading crypto fund who is active in primary and secondary markets, whose sub-funds include dedicated eco fund, FoF, hedge fund and Meta Fund.

LD Capital has a professional global team with deep industrial resources, and focus on develivering superior post-investment services to enhance project value growth, and specializes in long-term value and ecosystem investment.

LD Capital has successively discovered and invested more than 300 companies in Infra/Protocol/Dapp/Privacy/Metaverse/Layer2/DeFi/DAO/GameFi fields since 2016.

website: ldcap.com

twitter: twitter.com/ld_capital

mail: BP@ldcap.com

medium:ld-capital.medium.com