[LD Capital] Coinbase: Analysis of Investment Logic & Growth Potential

I. Investment Logic

1. Asset Category — U.S. Stock Compliant Exposure to the Crypto Market.

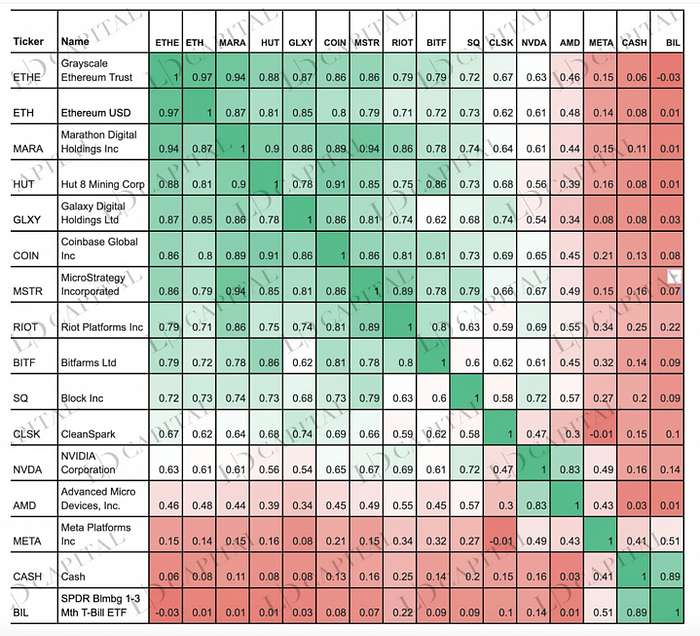

Coinbase’s stock price has surged over 120% this year, attributed to a 65% rise in Bitcoin since the beginning of the year and a 35% increase in tech stocks. Simultaneously following the U.S. stock and crypto markets, this dual-market correlation results in returns exceeding both markets when trending upward.

The graph showcases the correlation between COIN, ETH, and other related assets (MARA, HUT, GLXT, COIN, MSTR), all of which closely follow the ETH trend.

2. Primary Business Growth Potential Yet to Unfold

Coinbase’s main revenue comes from trading fees, affected by macro and industry cyclical factors. The “halving” event tends to spike market speculation, leading to a surge in trading volumes. However, the continuation of a high inflation, high-interest rate environment, not conducive to crypto growth, will still negatively impact Coinbase’s primary business in the coming 8–12 months.

For Coinbase, which only went public in May 2021 and faced a bear market immediately, growth is the core driver for stock price appreciation. Coinbase’s global site and derivatives trading only launched in May of this year. The global site will bring more spot trading volume, and derivatives will hugely drive trading income. On August 14, Coinbase announced its official entry into Canada, along with partnerships with Interac payment systems and the launch of other features, highlighting Coinbase’s focus on growth (both regional and business expansion). Thus, even with growth constraints in the next 12 months due to external factors, the potential for revenue growth is immense within 24 months considering the many positive factors yet to be unveiled.

3. First-half EBITDA Surpassed Expectations, Overshadowing Second-half Profit Forecasts.

Coinbase achieved an adjusted EBITDA of $194 million in Q2 2023, significantly exceeding expectations, primarily due to the cost-cutting plan implemented a year ago, which led to a nearly 50% year-over-year reduction in operational costs. Due to continued macro headwinds, a profound bearish crypto cycle, and added external compliance pressures, we believe that this non-organic growth through cost-cutting will overshadow profit growth in the next two quarters. The profit outlook for the second half of this year into next year is relatively dim.

4. Coinbase Vigorously Developing Auxiliary Businesses to Uncover New Growth Points

· International and Derivative Trading Business — Coinbase’s derivative exchange is indeed still in its early stages, with the current business volume at 50 institutions and a contract trading amount of $5.5 billion. But Q2 only saw the launch of the API test version, with very few clients. Thus, Coinbase’s next steps include integrating it into retail applications. Once the international site and derivative products are officially launched, they will lead to substantial revenue growth.

· USDC Business — Coinbase is acquiring equity in Circle (a minority stake) without disclosing specific investment figures. This investment implies that Coinbase and Circle will have a more significant strategic and economic alignment in the development of the future financial system. It foreshadows broader prospects for USDC, potentially expanding from cryptocurrency trading to areas like forex and cross-border transfers. Coinbase executives have downplayed competition with PayPal entering the stablecoin realm (with PYUSD having a minor 44mln Supply market share). Coinbase and Circle will continue to earn from the interest income of USDC reserves. Based on their new agreement, this income will continue to be allocated based on the amount of USDC held on the platform and will also equally share interest income from the broader distribution and use of USDC.

· On-chain Business — After the launch of Base, the additional MEV revenue generated will be a direct profit for Coinbase. Apart from this direct profit opportunity, Coinbase CFO Alesia mentioned in a call that the usage of Base would provide opportunities for all other products and services offered by Coinbase. For instance, users will utilize Coinbase’s payment channels and wallet products, which will also bring in auxiliary revenue. Additionally, the ETH Staking business brings at least $100 million in revenue to Coinbase.

5. Coinbase may continue to capture a larger market share from Binance, potentially becoming the leading exchange.

The SEC’s allegations against Binance are more severe. Besides the same charges as Coinbase, which include operating unregistered securities exchanges, brokers, and clearing agents, the SEC has also accused Binance of activities similar to FTX: deception, blending assets across entities, and making counterparty trades with customers. Such charges have not been raised against Coinbase. The global crackdown on competitor Binance is favorable for Coinbase, suggesting that Coinbase might replace Binance as the most influential exchange.

6. Coinbase’s necessary compliance credentials position it as one of the primary beneficiaries for Spot ETFs.

After the approval of Spot ETF applications by traditional asset management institutions, Coinbase stands to benefit greatly as a potential custodian. Coinbase will earn major revenue from the custody of these soon-to-launch Spot ETFs through its Average Annual Custody Asset Cost (AUCC). It is believed that future additional revenues can be made from clearing and other services. However, many issues need resolution, and there’s a significant time window.

7. Regulatory pressure results in increased compliance costs.

Despite Coinbase’s strong performance during the prolonged crypto winter, ongoing regulatory uncertainties remain a negative factor for the company. Regarding the SEC’s lawsuit against Coinbase, the company seeks to dismiss the SEC lawsuit filed in June (charging the company with operating unregistered exchanges, brokers, and clearing agencies). An SEC victory isn’t guaranteed, with a likely settlement outcome. Settlement fines could have a significant impact on the company’s profits (e.g., Kraken’s 30 million USD fine). This will affect the company’s fundamentals, but the market might interpret it as positive news.

Regarding services similar to bank/financial institution deposits, Coinbase may need permissions from the Federal Reserve System, the FDIC, the Office of the Comptroller of the Currency (OCC), or state-level banking regulators. In other regions, corresponding permissions are also necessary. This will raise operational costs (Compliance Cost), and without the necessary licenses, there’s always a risk of fines and shutdowns. Varied regulations worldwide also restrict Coinbase’s international expansion.

In conclusion, current projections suggest Coinbase’s profitability will remain suppressed for the next 12 months. However, the potential for revenue and profit growth might manifest within 24 months. Unaccounted growth drivers include: 1) Significant revenue growth after the official launch of international platforms and derivative products. 2) Continuous growth of the staking business, including base chain (and other chains) sorting income; staking revenue; and increased usage of other Coinbase products and services by on-chain users. 3) Potential volume recovery of USDC bringing reserve interest income and fees generated during distributions. Still, given the close ties with the crypto market’s trends, no significant growth in trading revenue is expected in the pessimistic 8–12 month outlook against a backdrop of high inflation and high-interest rates detrimental to crypto growth. However, growth rates will surpass the 515% increase of 2021 during subsequent bullish phases.

Valuation suggests that under baseline scenarios, Coinbase’s fair value is 89 USD, currently undervalued by 16% at 74 USD. However, when combining the DCF valuation model, the predicted annual business growth, and terminal EV/EBITDA multiplier sensitivity are high. It’s essential to consider the inherent cycles of the crypto market and market sentiment. With short-term stock prices under pressure from deep bear phases in both US stocks and the crypto market, a practical operational suggestion would be to sell over the next 12-month cycle and buy during the subsequent 24-month cycle. At an EV/EBITDA of 7x, the fair value is 89 USD, and at 14x, the fair value is 170 USD.

II. Company Background and Business Introduction

Established in 2012, Coinbase operates a diversified cryptocurrency business and is the largest crypto asset trading platform in the US, serving over 108 million customers. Users can buy, sell, and trade crypto assets on this platform. On April 14, 2021, Coinbase went public on NASDAQ, becoming the “first cryptocurrency stock.” In the second quarter of 2023, its trading revenue reached 327 million USD, accounting for about half of its net sales and representing its main business income. Coinbase also earned over 200 million USD from interest income in collaboration with USDC, the market’s second-largest stablecoin. Although it’s a smaller business line, it’s seen as a significant project for expanding supplementary income. Other product lines include cloud services and high-yield tokens called “staking” products.

Looking at specific business lines:

1) Coinbase App — Targeted towards ordinary traders.

Users can trade tokens on the platform. The first fee income option is to pay transaction fees according to a transparent pricing plan. This includes transaction fees and spreads added when consumers buy, sell, or convert crypto assets in fiat-to-crypto or crypto-to-crypto trades. These transaction fees are fixed based on a percentage of the user’s trading volume on the company’s platform, simplifying transactions (excluding small trades which have fixed fees) and tiered fees for advanced trades. The second option is Coinbase One, a subscription product where consumers pay a monthly fee instead of transaction fees until a specific trading volume threshold. However, for straightforward trades, spreads will still be charged.

The Coinbase app has expanded proprietary product experiences, offering its customers point-to-point payments, remittances, direct deposits, and its Coinbase card (a Coinbase-branded debit card). Moreover, users can earn crypto returns in multiple ways, including staking rewards, DeFi yields, and other unique methods for certain cryptos.

For most consumers, staking crypto assets is technically challenging. Independent staking requires participants to run their hardware and software, maintaining nearly 100% uptime. The company offers genuine on-chain proof-of-stake services, reducing staking complexity, allowing consumers to earn staking rewards while fully owning their crypto assets. In return, the company takes a commission from all staking rewards. Its recent Cloud product also integrated the on-chain staking protocol Kiln, offering Ethereum staking below the 32 ETH limit.

2) Two Wallet Products

Web3 Wallet

Users can access third-party products by adding a “web3 wallet” to their Coinbase application. The web3 wallet allows the company’s customers to interact with specific Dapps, including trading on decentralized exchanges or accessing art and entertainment services. This product provides consumers convenience in easily accessing and interacting with Dapps. It also shares the responsibility of knowing and storing customer’s secure keys between the consumer and Coinbase, making wallet recovery possible. The company generates profit by charging fees for certain transactions made on decentralized exchanges.

Coinbase Wallet

Coinbase offers a software product called “Coinbase Wallet” to consumers in over 100 markets, enabling them to interact with Dapps and crypto use cases without a central intermediary. The Coinbase Wallet experience is similar to the Web3 Wallet, but with key differences, including the consumer having full control over their private keys and seed phrases and having access to a broader range of assets and use cases in web3. The company generates profit from some transactions made on Dapps, such as charging fees for fiat-to-crypto transactions and/or fees for trades on decentralized exchanges.

3) Institutional Business

Coinbase offers two products that serve institutional clients (not limited to market makers, asset management companies, asset owners, hedge funds, banks, wealth platforms, registered investment advisers, payment platforms, public and private companies, etc.).

Coinbase Prime is a comprehensive platform serving all institutional spot crypto needs through a brokerage model. It provides trading, storage, transfer, collateral, and financing services to institutions. Through Coinbase Prime, institutions can access deep liquidity pools in the crypto market, and benefit from best price execution due to the company’s access to a range of connected trading venues, including the Coinbase Spot Market. The company offers volume-based pricing and charges transaction fees for each matched trade.

Additionally, it provides market infrastructure for trading venues via the Coinbase Spot Market and Coinbase Derivatives Exchange.

Coinbase introduced the first regulated derivative products on the Coinbase Derivatives Exchange, namely Nano Bitcoin futures and Nano Ethereum futures contracts. Coinbase is the first crypto-native platform to gain recognition in the regulated derivatives market, offering opportunities for other derivatives intermediaries to trade on its derivatives exchange. Pending regulatory approval, the company will directly offer these derivative products to its customers (currently only available to institutions).

4) Developer Suite

The developer suite includes some of the latest products, like Coinbase Cloud and Coinbase Pay. Coinbase Cloud offers crypto payment or trading APIs, data access, and staking infrastructure. These tools allow the company to build crypto products faster, simplifying interactions with blockchains. Coinbase Pay and Coinbase Commerce enable developers and merchants to more easily integrate crypto transactions into their products and businesses.

III. Financial Analysis

1. Business Model and Revenue Growth

Breaking down the revenue streams, transaction income remains the main source of income. Ancillary business grows in tandem with transaction revenue. However, as observed, in Q3 and Q4 of 2022, transaction revenue accounted for 61% and 52% of total revenue, respectively. In Q1 of 2023, it made up 48%. Subscriptions and other services have also brought considerable revenue to Coinbase, and their proportion is on the rise.

However, transaction revenue shows explosive growth during bull markets and a declining trend during bear markets. Subscription services and other businesses, on the other hand, show stable growth during bear markets and grow with transaction revenue during bull markets.

Business Revenue Classification

Transaction revenue is Coinbase’s primary source of income, comprising transaction fees: Coinbase earns money by buying and selling cryptocurrencies. It typically depends on the value of the transaction or might be based on a fixed fee. Spread: This is the difference between the buy and sell price of cryptocurrencies. Exchange fees: These fees convert one cryptocurrency into another and come from the company’s transaction revenue streams. Over-the-counter trades: This service targets institutional buyers and those making large trades or high-frequency trading. Leveraged trades: It also allows users to borrow from the platform, involving interest and borrowing fees paid by users.

Payment processing fees: It also permits users to make payments using cryptocurrencies from its platform.

In the first quarter of 2023, Coinbase recorded a total trading revenue of $375 million USD. This followed revenues of $322 million USD in the fourth quarter of 2022 and $366 million USD in the third quarter of 2022. Trading revenue comprised 48.5% of the total for Q1 2023.

Subscription and Service Revenue:

Coinbase offers subscription services that include Coinbase Pro, Coinbase Prime, and Coinbase Custody. Coinbase Pro serves as an advanced trading platform tailored for professional and institutional investors. It offers certain free functionalities alongside premium features available through subscription. Coinbase Prime, designed for institutional investors, provides enhanced trading capabilities, dedicated account management, and liquidity solutions.

Coinbase Custody primarily offers secure custodial solutions for institutional clients, facilitating the safe storage of cryptocurrencies. Additionally, insurance coverage is extended for digital assets.

The subscription and service revenue for Coinbase in Q3 2023 stood at $210 million USD. In Q3 and Q4 of 2022, these figures were $283 million and $362 million USD respectively, showcasing a consistent growth. The peak was achieved in Q1 2023, reaching $362 million USD. Income from these subscription services made up 46.82% of the total revenue for Q1 2023.

Other Revenue Streams:

Other revenue sources for Coinbase include Coinbase Commerce, Coinbase Cards, interest income, institutional services, and various other products and services.

Other incomes made up approximately 4.5% of the total. This amount was approximately $14 million USD in Q3 2022 and increased to $24 million USD by Q4 2022. There was a threefold increase in Q1 2023 compared to Q3 2022.

Looking at regional revenues, although Coinbase serves customers in over 100 countries, the majority are concentrated in the U.S. (around 40%), followed by the UK/Europe at approximately 25%. Yet, the U.S. revenue share from FY2019–2022 was 78%, 76%, 81%, and 84% respectively, much higher than other regions. In August this year, Coinbase announced its entry into the Canadian market, but growth in other areas could be restricted due to local regulations and competition from local exchanges.

2. Profit Breakdown

Coinbase enjoys a high profit margin, a defining feature of SaaS companies, with a profitability of 46% in 2021. The primary profit sources include the aforementioned trading income and subscription services. Revenues from the Staking business, MEV earnings, and USDC are reflected in the ‘other incomes’ category (with earnings from Staking at $100 million USD, and USDC earnings at $200 million USD). Bond buybacks have reduced interest expenses (by $5.4 million USD), which is anticipated to augment the net profitability rate, albeit with a minor impact.

Staking and Base MEV Revenue:

Coinbase serves as the sole Sequencer for Base, allowing it to gain priority gas profits from the Base chain due to sequencing.

Based on the formula: L2 earnings = L2 fees — L1 storage costs — L1 validation costs, the estimated sequencing fee from Base’s accumulated costs suggests that out of the difference between $5.46 million and $3.54 million, half could go to Coinbase, amounting to around $1 million USD. However, in reality, Coinbase relies on charging a commission of 25%-35% on staked ETH for revenue.

The income brought by the Base chain to Coinbase reaches $1 million (a smaller absolute value if the actual commission charged by Coinbase is considered). Observing the quantity of ETH staked by Coinbase, it ranks first among all CEXs, with a market share of 8.6%. It’s second only to Lido. The realized ETH income is approximately 187k, equivalent to $300 million USD. Of this, Coinbase takes a 25%-35% commission, translating to a revenue of around $100 million USD from the Staking business.

Coinbase’s EBITDA remains around 40% of its revenue. This ratio may decrease when the main income cannot grow due to cyclical and macro factors, or when external costs, such as regulatory fines, increase. However, with the onset of a bull market, the EBITDA-to-revenue ratio is likely to increase.

USDC Operations

Currently, Coinbase holds 232 million USDC, second only to Binance. The value of USDC declined due to the Q1 banking crisis, which led to the failure of Silicon Valley Bank, prompting a significant amount of USDC to be redeemed, as well as Binance’s decision to exchange USDC for another stablecoin. However, Coinbase’s CEO Brian mentioned in a call that over the past 6 to 7 weeks, available data indicates a net increase in the market value of USDC, an important data point. He also noted the potential for increased regulatory risk in the US, given that many perceive USDC to be more closely associated with the US compared to other stablecoins like Tether, which could pose challenges for USDC in the short term.

Circle reported revenues of $779 million in the first half of the year, surpassing the $772 million for the entirety of 2022. It achieved an EBITDA of $219 million in the first half, which also exceeded the previous year’s total of $150 million. However, the overall market value of USDC has declined, with its current market share standing at just 21%. This might explain the strategic consideration behind partnering with Coinbase as an investor and planning to launch USDC on six new blockchains between September and October to prevent further market share decline. It’s clear that Coinbase places significant emphasis on its stablecoin operations and aims to maximize revenues in this segment.

3. Costs

In January 2023, the company announced and completed a restructuring that affected approximately 21% of the total number of employees as of December 31, 2022 (referred to as “2023 Restructuring”). This restructuring aimed to address the market conditions impacting the crypto economy and ongoing business priorities, in order to manage operational expenses. As a result, around 950 employees from various departments and locations were laid off. As part of the layoffs, they received severance compensation and other HR benefits. Cash payments related to this restructuring were largely completed in the second quarter of 2023, with the remainder expected to be paid by December 31, 2023. The reduction in labor costs, which decreased operational expenses by 50%, is a significant reason for Coinbase’s positive EBITDA in both Q1 and Q2, surpassing expectations.

Regarding operational expenditures, on March 3, 2023, the company completed the acquisition of One River Digital Asset Management, LLC. (“ORDAM”), acquiring all issued and outstanding membership interests. ORDAM is an institutional digital asset management firm, registered as an investment advisor with the U.S. Securities and Exchange Commission (SEC). The company believes this acquisition aligns with its long-term strategy and will provide more opportunities for institutions to participate in the crypto economy. The total consideration paid for the acquisition was $96.8 million.

4. Borrowing Costs

On August 7, 2023, Coinbase announced a cash tender offer at a price of 64.5 cents (before August 18) or 61.5 cents (after August 18 but before September 1) to purchase up to $150 million of its unsecured senior notes due in 2031. Coinbase will finance this transaction through its operating cash flows. This tender offer follows the June 2023 repurchase of $645 million of its 0.5% convertible senior notes due in 2026 at a 29% discount, amounting to $45.5 million in cash. Given Coinbase’s ample liquidity and no imminent refinancing risks, this transaction is deemed profitable and is not expected to pose a cash crunch for Coinbase. The transaction will further increase the company’s excess cash reserves by taking advantage of the offered discount and reduce its annual interest expenditure by approximately $5.4 million.

In theory, Coinbase’s proactive use of cash tender offers to purchase some of its future maturing debts can help reduce its future interest expenditures, enhancing financial stability. This strategy can boost market confidence: improving the company’s debt repayment capacity and financial strength might elevate market perception, potentially enhancing stock prices and credit ratings while reducing borrowing costs.

IV. Valuation

DCF Analysis

To perform a discounted cash flow analysis for Coinbase, the current D/V (67%) and E/V (33%) ratios based on Coinbase’s capital structure were used. Coinbase’s leveraged equity beta value was calculated to be 3.15. Using the CAPM model, with a market risk premium of 7% and a risk-free rate of 5.5%, the cost of equity was determined. The cost of debt for the company’s senior notes was used, combined with an effective tax rate of 27% to obtain the after-tax cost of debt. This resulted in the company’s weighted average cost of capital (WACC) being 23.58%.

WACC Analysis Coinbase

Coinbase — Levered Beta & WACC Calculation

Considering the current high interest rate environment, it is believed that this elevated level may persist until July of next year. Therefore, the terminal value calculated in the DCF model leans towards a more conservative level. Growth rate estimates for FY2023–2025 are -5%, 10%, and 500% respectively.

Valuation Rationale and Recommendations

The valuation suggests that under the base scenario, Coinbase’s fair value stands at $89 per share, which is 16% undervalued compared to the current price of $74. However, considering the high sensitivity of the DCF valuation model to forecasted annual business growth and terminal EV/EBITDA multiples, it is imperative to take into account the inherent cycles and market sentiment of the crypto market. In the short term, stock prices are pressured by both the bearish U.S. stock market and crypto market conditions, facing downward momentum. A practical strategy is to sell for the next 12 months and then buy for the subsequent 24 months. At an EV/EBITDA of 7x, the fair value is $89, and at 14x, the fair value is $170.

Recommendation: Investment Cycle: Sell for the next 12 months. Buy for the subsequent 24 months, with target prices at $89 for EV/EBITDA of 7x and $170 for 14x.

V. Risk — Regulatory Uncertainty

Coinbase is seeking to dismiss a lawsuit filed by the SEC in a New York federal court in June against the U.S. compliant cryptocurrency trading platform Coinbase, Inc. and its parent company, Coinbase Global, Inc. The lawsuit accuses the company of operating unregistered exchanges, broker-dealers, and clearing agencies.

The focus of the complaint is that, according to the Securities Exchange Act of 1934, traditional securities markets have separated roles for brokers, exchanges, and clearing agencies. However, Coinbase has merged these three functions and has not registered with the SEC, nor has it obtained any applicable exemptions. For years, Coinbase has flouted the regulatory structure, evading disclosure requirements from Congress and the SEC.

At the same time, Coinbase has provided two additional services to investors, acting as an unregistered broker: Coinbase Prime (Prime), which routes cryptocurrency asset orders to the Coinbase platform or third-party platforms; and Coinbase Wallet, which routes orders via third-party cryptocurrency trading platforms to obtain liquidity outside the Coinbase platform.

Coinbase has continuously earned trading revenue by providing crypto assets, overlooking that these assets have the nature of securities. Moreover, since 2016, Coinbase has understood that crypto assets should be regulated by securities laws and has always marketed itself as a compliant platform. While they verbally expressed a willingness to comply with applicable laws, they continuously allowed crypto assets that meet the Howey Test standards to be traded.

Since 2019, Coinbase has offered Staking services, allowing investors to earn returns by staking. Coinbase charges a commission of 25–35%. However, Coinbase has never registered the Staking project’s issuance and sale with the SEC, depriving investors of crucial information about the plan, harming their interests, and violating the registration provisions of the Securities Act of 1933.

All of Coinbase’s revenues flow into its parent company, CGI. In reality, CGI is the actual controller of Coinbase, and therefore, CGI also violated the same trading regulations as Coinbase.

The SEC seeks a final judgment:

(a) permanently prohibiting the defendant from violating securities law-related provisions;

(b) ordering the defendant to surrender illegal gains and pay pre-calculated interest;

© imposing civil fines on Coinbase and demanding that it provide appropriate or necessary fair relief for the benefit of investors.

(Note: In the SEC’s judgment against Binance, it also prohibited it from permanently engaging in finance-related businesses.)

Summary

In conclusion, it is believed that Coinbase’s profitability will continue to be suppressed in the next 12 months, but the potential for revenue and profit growth will be unleashed within 24 months. Unpriced growth in revenue includes:

1) Substantial revenue growth after the official launch of international stations and derivative products.

2) Continuous growth of the staking business, including base chain (and other chains) ranking revenue; staking business revenue; increased usage of Coinbase’s other products and services (like wallets) by on-chain users.

3) Potential volume recovery of USDC bringing reserve interest income and growth in fees generated in distribution. However, due to the strong correlation with crypto market trends, it is anticipated that the main business transaction income will not grow significantly against the backdrop of a macro pessimistic 8–12 month period that is unfavorable for crypto growth during high inflation and high-interest rate environments. But in the subsequent bull market, the growth rate will exceed the 515% growth of 2021.

Valuation indicates that, in a base scenario, Coinbase’s fair value is $89, undervalued by 16% at the current price of $74. However, considering the high sensitivity of the DCF valuation model to the forecasted business growth and terminal EV/EBITDA multiplier, combined with the endogenous cycle and market sentiment of crypto market trading, the short-term stock price is facing downward pressure due to the bearish sentiment in both the US stock and crypto markets. The more practical operation recommendation is to sell out for the next 12-month cycle and then buy in for the subsequent 24-month cycle. At EV/EBITDA 7x, the fair value is $89, and at 14x, the fair value is $170.

Appendix

Compliance Status

The CEO of Coinbase believes that the MiCA bill passed in Europe, but the UK, Singapore, and Brazil, every financial center, are actively trying to pass legislation, with other countries leading the way ahead of the US.

Coinbase is also striving to provide regulatory clarity for the entire industry. One of the biggest obstacles to adopting this technology is the lack of clear rules and the enforcement regulation in the US so far. Although other parts of the world have made significant progress in accepting crypto and web3 technologies and have established clear legislation, the US has always had difficulty catching up. Coinbase plays a crucial role here. When the SEC refuses to make rules and chooses an enforcement regulation method instead, Coinbase uses the courts to help bring regulatory clarity to the US and create case law. Coinbase is also actively involved in congressional activities, where bipartisan support for crypto legislation is evident.

In just the past few weeks, the House Financial Services Committee and the House Agriculture Committee passed the landmark crypto market structure bill (FIT21) and the stablecoin bill with bipartisan support. These bills will be submitted to the full House for voting later this year and then forwarded to the Senate. Coinbase promises to help ensure the US passes crypto legislation and is not left behind. It has also begun mobilizing crypto users across the US to ensure their voices in Coinbase’s democratic system can be heard. Now, one-fifth of Americans have used cryptocurrency — a higher proportion than those holding union cards. So far, the “Support Crypto” campaign has attracted about 60,000 crypto advocates, covering 435 congressional districts. For example, on how we activate in today’s New York City events, before COINBASE in August, there were live gatherings with Senator Gillibrand’s office, Mayor Adams’ office, Governor Hochul’s office, and hundreds of crypto enthusiasts.

Coinbase is regulated by various anti-money laundering and counter-terrorism financing laws, including the US Bank Secrecy Act (BSA) and similar laws and regulations abroad. In the US, as a money service business registered with the US Treasury’s Financial Crimes Enforcement Network (FinCEN), the BSA requires the company to develop, implement, and maintain a risk-based anti-money laundering program, provide anti-money laundering training programs, report suspicious activities and transactions to FinCEN, comply with certain reporting and record-keeping requirements, and collect and maintain information about its customers. Moreover, the BSA requires it to comply with certain customer due diligence requirements as part of its anti-money laundering obligations, including developing risk-based policies, procedures, and internal controls designed to verify customer identities.

Coinbase has implemented a compliance program aimed at preventing its platform from being used to facilitate money laundering, terrorist financing, and other illegal activities, whether domestically or in transactions with foreign countries, individuals, or entities on the Foreign Assets Control Office (OFAC) designated list.

In the US, Coinbase has obtained the necessary licenses to operate as a money transmitter or equivalent money transmitter in the states required for its business operations, including the District of Columbia and Puerto Rico. Additionally, it has obtained the BitLicense from the New York State Department of Financial Services (NYDFS).

Outside of the United States, Coinbase has obtained a license from the German Federal Financial Supervisory Authority to provide crypto asset custody and trading services. The company is also registered in Japan as a crypto asset exchange service provider, offering crypto asset and primary payment services according to the registration with the Kanto Local Finance Bureau of the Japanese Ministry of Finance. In Singapore, the company operates under the Payment Services Act and is supervised by the Monetary Authority of Singapore (MAS). Currently, the company is in a preliminary approval state and requires final approval from MAS to become a major payment institution. Under these licenses and registrations, it is subject to a broad range of rules and regulations, including anti-money laundering, client asset protection, capital requirements, suitability and propriety of management, operational controls, corporate governance, customer disclosures, reporting, and record-keeping.

Coinbase’s subsidiary, Coinbase Custody Trust Company, LLC, is a limited-purpose trust company approved by the State of New York and is regulated, examined, and overseen by the NYDFS (New York Department of Financial Services). NYDFS regulations impose numerous compliance requirements, including but not limited to, operational restrictions concerning the nature of crypto assets that can be held in custody, capital requirements, BSA and anti-money laundering program requirements, affiliated transaction limitations, and notification and reporting requirements.

Coinbase provides services to its clients through electronic money institutions authorized by the UK’s Financial Conduct Authority and the Central Bank of Ireland. The company adheres to rules and regulations applicable to the European electronic money industry, including those related to fund custody, corporate governance, anti-money laundering, disclosure, reporting, and inspection.

Coinbase has established a set of policies and practices to evaluate each crypto asset it considers for listing or custody and is a founding member of the Crypto Rating Committee. Coinbase’s brokerage business is operated by Coinbase Capital Markets and Coinbase Securities, both of which are registered as brokers under the Securities Exchange Act of 1934, as amended, with the SEC.

LD Capital has a professional global team with deep industrial resources, and focus on develivering superior post-investment services to enhance project value growth, and specializes in long-term value and ecosystem investment.

LD Capital has successively discovered and invested more than 300 companies in Infra/Protocol/Dapp/Privacy/Metaverse/Layer2/DeFi/DAO/GameFi fields since 2016.

website: ldcap.com

twitter: twitter.com/ld_capital

mail: BP@ldcap.com

medium:ld-capital.medium.com